In this blog we dive into the liquid staking derivatives (LSDs) available in the Initia ecosystem and go through the strengths and tradeoffs of each approach. If you're unfamiliar with Initia itself, you can check out our previous blog or video overview where we cover the L1/L2 architecture and key innovations. Today we focus on the three major LSD competitors aiming for INIT staking market dominance: MilkyWay, Drop, and Cabal. Each protocol has taken a distinctly different approach to liquid staking in Initia's unique architecture, creating an interesting market dynamic that's worth exploring.

Understanding Initia's Unique Staking Architecture

Before diving into the LSD products themselves, it's crucial to understand two core Initia mechanisms that make its staking ecosystem different from most chains: Vested Interest Program (VIP) and Enshrined Liquidity.

Vested Interest Program (VIP)

Initia's innovative approach to align L1 and L2 incentives. INIT stakers and InitiaDEX LP token stakers can direct incentives toward Minitias (Initia's L2s) through gauge voting. The program distributes esINIT (vesting INIT tokens) based on usage metrics like bridged tokens. The VIP follows a dual-pool reward distribution mechanism. For each distribution period, rewards are split between:

-

Balance Pool: Rewards are distributed proportionally based on the amount of INIT tokens locked in each Minitia. This incentivizes applications to find new and interesting uses for INIT tokens within their rollups.

-

Weight Pool: Rewards are distributed based on gauge weights determined through voting. This is where the governance aspect comes in - INIT stakers vote to direct incentives to their preferred Minitias, similar to Curve's gauge system.

The ratio between these pools is set by governance, creating a dynamic ecosystem where both usage and stakeholder preferences determine incentive flow. Crucially for LSD providers, having significant voting power in this system means they can direct substantial rewards toward strategic partners or their own ecosystem components. Crucially, unlike as in berachain, validators hold little power in the VIP process - users own their own voting power and choices.

Rewards are distributed as esINIT tokens that vest over time, with users needing to maintain certain activity levels to fully unlock them. Alternatively, users can immediately convert esINIT into locked LP positions on InitiaDEX. But in the end all of these rewards go to users of Interwoven rollups, not necesarilly the INIT stakers themselves, this dispersion is something we will come back to later.

If you want to learn more about the Vested Interest program then go check out the Initia documentation.

Enshrined Liquidity

Unlike traditional L1s where staking and DeFi are separate activities, Initia allows liquidity providers on its native DEX to stake their LP tokens directly into the consensus mechanism. This means LP tokens can earn both trading fees AND staking rewards. This "enshrined DEX" creates novel opportunities for LSDs to capture multiple yield streams at once. Similar to Berachain in a way we can expect staking rewards to be higher for interesting pairings on the Initia DEX as they receive more protocol inflation than native staking itself and have a smaller pool of users/AUM.

So unlike the traditional LP vs staking tradeoff that has plagued liquidity on so many POS and specifically high inflation (hello cosmos) POS chains, this is not supposed to be a problem on Initia. Staked DEX positions help not just the INIT token liquidity but also crucially the liquidity for MINITSwap which helps minimize the Optimistic bridging delay between Interwoven rollups and the Initia base layer.

These two differentiated staking mechanisms create multiple avenues for generating yield with INIT tokens beyond just traditional staking. Now let's dive into how each LSD protocol approaches these opportunities.

MilkyWay: Native Staking on an Interwoven rollup

MilkyWay initially gained attention as one of the first projects to announce support for Initia's ecosystem. Their approach to liquid staking is relatively straightforward but comes with an interesting twist.

Technical Implementation

MilkyWay's liquid staking is based of a fork of Stride's StakeIBC module, adapted specifically for Initia. Users deposit INIT tokens and receive milkINIT in return, which represents their staked position and accrues rewards over time. Unlike some competitors, MilkyWay takes the pure-play staking approach, focusing solely on native INIT staking rather than LP tokenomics or VIP voting strategies.

What makes MilkyWay unique is that it's not just an LSD - it's also launching its own full-fledged rollup on Initia. This creates an interesting dynamic where milkINIT becomes a native asset on the MilkyWay rollup, enabling integration with DeFi protocols built there. The protocol also leverages IBC for token transfers between chains, allowing users to transfer milkINIT from MilkyWay to other Minitias seamlessly using IBC and MinitSwap.

This dual role as both an LSD provider and rollup operator gives MilkyWay a strategic advantage in the VIP reward system. When users bridge milkINIT to the MilkyWay rollup, it effectively increases the amount of INIT-equivalent tokens locked in their ecosystem. Since the Balance Pool portion of VIP rewards is distributed based on the proportion of INIT tokens locked in each Minitia, this creates a powerful flywheel effect: more staking leads to more milkINIT, which when bridged to their rollup increases their VIP score, resulting in more rewards from the Balance Pool. These additional rewards can then be used to further incentivize users, attract more stakers, and strengthen their ecosystem. This virtuous cycle is something neither Drop nor Cabal can replicate since they don't operate their own rollups, giving MilkyWay a potential competitive edge despite its more traditional LSD approach.

Security and considerations

MilkyWay operates by delegating user funds across a set of Initia validators based on their own selection criteria. This introduces centralization risk in validator selection, but follows the standard model used by most liquid staking protocols in the industry and shouldn't be too problematic. We might See Milkyway vote for all their users in the VIP gauge process instead of forwarding their votes. This loss of voting power for users might be considered an issue but it will once again strengthen the flywheel of earning more VIP esINIT rewards as mentioned above.

Eventhough Milkyway itself seems to be a benefactor of the VIP design, a clear limitation of MilkyWay's approach is that it doesn't directly leverage Initia's unique mechanisms like enshrined liquidity or VIP gauge voting for its users. While milkINIT holders may eventually gain exposure to these features through protocols built on the MilkyWay rollup, the base token itself represents only the native staking yield. Additionally, while MilkyWay was first to announce, their focus on building a complete L1 for restaking alongside their liquid staking module does reduce some of that initial benefit.

Drop: LSD Built on Staked DEX Positions

Drop Protocol takes a significantly different approach by focusing on Initia's enshrined liquidity mechanism rather than pure staking, creating what they call the first LSD built on a staked DEX position.

Technical Implementation

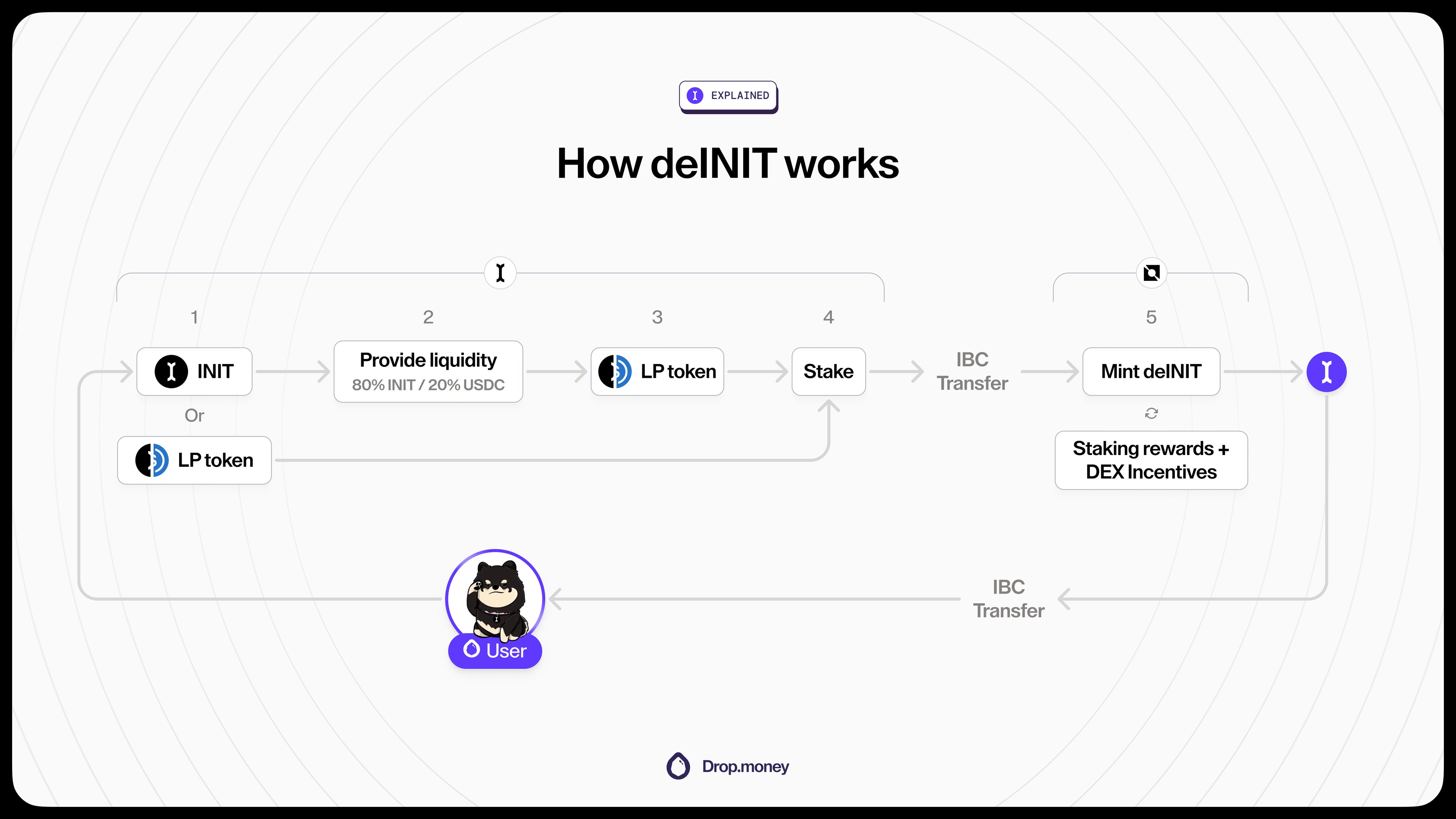

Drop introduces deINIT, a liquid staking token that represents not just staked INIT, but staked INIT-USDC (80%/20%) LP tokens. This is a fundamentally different approach - users aren't just getting exposure to staking rewards, but also to:

- Trading fees from the INIT-USDC pool

- Staking rewards from the enshrined DEX mechanism

- Potential extra incentives directed to the pool

The mechanism is designed for maximum capital efficiency and works in two possible ways:

- Single-asset staking: Users deposit INIT, and Drop automatically converts 20% of the position into USDC to form an 80/20 INIT-USDC LP position. These LP tokens are then staked in Initia's consensus mechanism through the enshrined liquidity feature.

- Direct LP staking: Users who already hold INIT-USDC LP tokens can stake them directly to receive deINIT.

In both cases, users receive deINIT as their liquid receipt token. What makes this approach special is that rewards from both trading fees and staking are automatically compounded back into the LP position, continuously growing the underlying value without requiring any user action. This creates a self-sustaining engine where capital remains productive in multiple ways simultaneously.

Drop has also introduced their "Droplets" program, which further incentivizes deINIT holders. Phase two of this program includes another 5% tranche of the total drop tokens to Droplet Points holders and deINIT stakers will be earning a majority of those points. This creates an additional layer of incentives beyond the base LSD yield.

Security and considerations

The key advantage of Drop's approach is potentially higher yields through combined revenue streams and automatic compounding. By integrating staking and liquidity into a single position, it solves the traditional inefficiency where users must choose between staking or providing liquidity.

However, this comes with different risk factors:

- Impermanent loss from the INIT-USDC position, particularly if INIT price changes significantly

- Complexity in understanding the true value accrual mechanism

- Smart contract risks inherent to the automatic conversion and compounding processes

The primary question for users is whether the additional yield and capital efficiency outweigh these risks compared to pure staking options. Drop's approach particularly appeals to users who want a "set and forget" solution that maximizes productivity of their INIT holdings across multiple yield sources.

We should also assume that the share of INIT holders that are open to creating LP tokens is always smaller than native stakers. Holders are not always defi-savvy and there might be large sets of private investors, airdrop recipients and other holders that are not fully liquid (vesting) or wealthy (no USDC) enough to match their INIT tokens with stablecoins.

So where staking float goes as high as 70% on certain chains, probably only 20-30% of that will be enshrined liquidity on Initia and off that only maybe 50% will be specifically the Init/USDC pool. So although Drop can take a higher commission on a higher APR potentially, the total stakeable TVL will likely be a lot lower.

Cabal: Native staking with Bribery Mechanics

Lastly the recently announced Cabal takes yet another approach, focused on maximizing yield through VIP gauge voting and bribery mechanics while still maintaining the simplicity of native staking.

Technical Implementation

At its core, Cabal offers a traditional liquid staking service - users deposit INIT and receive a liquid receipt token in return. The INIT is staked through a curated set of validators, and rewards either accrue to the token value through rebasing or can be claimed separately (the exact mechanism seems to be TBD).

What makes Cabal unique is its focus on the VIP gauge voting system. The protocol will leverage its staked INIT to vote on VIP gauges according to directions from "bribers" - projects and users willing to pay for voting power. All bribe revenues are then distributed to LSD holders, creating an additional yield source beyond just staking rewards.

Bribery Mechanics

Cabal's bribery system allows protocols to pay for gauge votes in any token, which are then distributed to LSD holders. This creates a diverse revenue stream that will outperform pure staking yields substantially. We've seen similar mechanisms work effectively in ecosystems like Curve and Balancer, and our own experience building BeeBribes for Berachain demonstrates the potential of well-designed bribery systems. The total added yield is all dependent on the total of rewards emitted through VIP but this calculation so far looks good as a lot of the INIT tokenomics are set aside for VIP.

Ex. Assuming Cabal has 10% of Initia's active voting power on a bonded rate (to FDV) of 40% and then following a potential 5% of FDV going to VIP in year 1 of which 50% is determined by gauges then Cabal will be directing just slightly less tokens in incentives than it has locked in its LSD. Assuming Bribers are willing to pay a rough 1-15 ratio cabalINIT stakers would be getting between ~6.5% APR on top of the native staking APR. If the native staking APR will be relatively low (as hinted at by the team) that could be a full 100% extra yield.

The protocol will also charge their dApp fees mainly in INIT and USDC, which helps maintain sustainability without creating sell pressure from token conversions. This way Intwerwoven rollups enjoy working with Cabal as they know bribing creates more token holders for them and not direct sell pressure by the protocol compounding it into usdc or taking massive fees themselves.

Security and considerations

A notable advantage for Cabal is that it's built natively in Move on the Initia L1, potentially offering better efficiency and integration with the core protocol. The founding team includes experienced builders with connections to the Initia ecosystem, and they've raised from investors that are invested in the L1 as well like Delphi and HackVc.

Cabal's approach introduces some governance risks, as voting power becomes commoditized through the bribery system. However, for yield-seeking users, this could represent the highest-earning INIT LSD option if the bribery market develops significant depth.

So, Who Wins The INIT LSD Race?

Analyzing the three contenders, we can see distinct market segments forming:

MilkyWay offers the simplest, most traditional LSD experience, but may struggle to compete on yield alone since it doesn't leverage Initia's unique mechanisms. Its value proposition largely hinges on integration with the MilkyWay rollup ecosystem, which may take time to develop. While it was first to announce, its divided focus may have allowed competitors to catch up.

Drop creates an interesting hybrid between LSD and LP positions, likely attracting users who want exposure to both staking and trading activity. Their deINIT might appeal to users who believe in the long-term trading volume of INIT-USDC pairs and want to earn fees alongside staking rewards. However, the impermanent loss risk and complexity might deter some users and their total TAM is a lot lower than just native staking, especially as other vault products arise.

Cabal is positioned to potentially offer the highest yields through its bribery system, particularly appealing to yield maximizers who don't mind the slight centralization in validator selection. If Initia's ecosystem grows significantly and competition for VIP gauge votes intensifies, Cabal holders could see substantial rewards beyond base staking yields, however that is potentially also the drawback. We have seen cosmos users steer away from deep DeFi complexity before and maybe this market never kicks off.

In our assessment, the market will likely segment rather than a single winner taking all:

- Drop will likely capture significant market share among users who want LP exposure alongside staking, better to be liquid if there is little downside

- Cabal stands to dominate among pure yield maximizers, particularly as the bribery market matures, expecting a potential 10-20% market share of stakeable float doesnt seem out of the question

- MilkyWay may struggle to compete on yield alone but could find a niche if their rollup ecosystem develops unique DeFi opportunities for milkINIT, especially early days when VIP rewards are high they might take the lead

The mature liquid staking markets we've seen in Ethereum and Cosmos suggest that 2-3 major players typically emerge, and Initia seems to be following a similar pattern, just with more diverse approaches due to its unique staking architecture. It is cool to see the Initia LSD landscape is evolving with every dApp focusing on other parts of Initia's architecture - a testament to the flexibility and innovation potential of the platform itself.